Frequently Asked Questions

Product and Features

RISCMTP-Notes are investment securities issued with a 10 year maturity that are:

- exchange-listed and transferable securities with market I.D. numbers (i.e., CUSIP: G75730AA2, ISIN: USG75730AA25)

- predominantly backed by a portfolio of US Treasuries

-

expected to be rated [Aaa by Moody’s]

-

redeemable at the Noteholder’s option at any time, for same-day settlement, on an In-Kind or Liquidated Asset Valuation basis

-

redeemable at Book Value on Annual Optional Redemption Date at Issuer’s or Noteholder’s option (again, for same-day settlement)

- priced daily and viewable on Bloomberg (Ticker RFPSGP)

-

Capital preservation and low volatility

- Tri-party-eligible

- Repo-eligible

The Notes will pay interest quarterly. The quarterly coupon on the Notes will be based on a pass-through of realized cash coupons and realized accretion (e.g., on T-Bills) received on the Note Portfolio assets, including the interest earned on the interest received, less fees payable to the IM for the coupon period, subject to a minimum coupon of 0.00%.

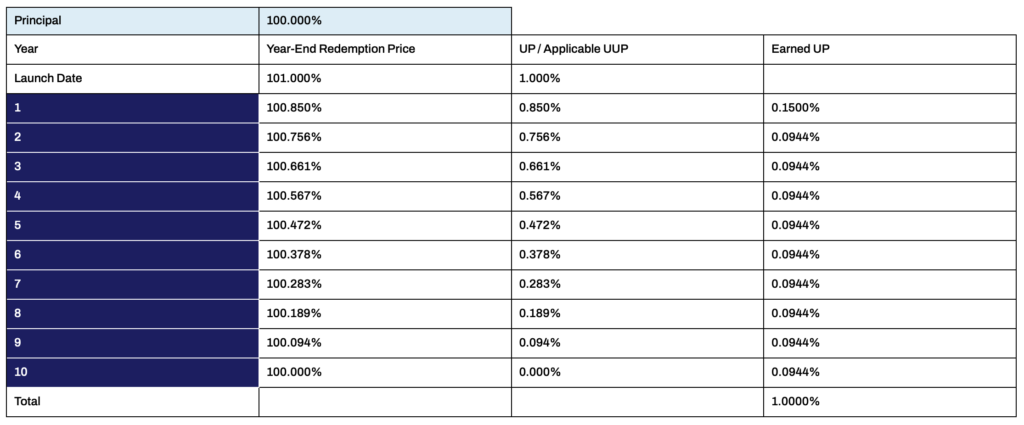

101.0% of the principal amount of the Notes, which includes an Unamortized Utility Premium (the UUP) of 1%. The UUP will be earned/amortized on an annually-in-advance basis, reducing by 0.15% on the Issuance Date and 0.0944% on each of the following nine anniversary dates of the Notes (each an Issuer and Noteholder Annual Optional Redemption Date). For example, on the first Annual Optional Redemption Date, Noteholders will have the right to redeem their Notes at Par + UUP, which, based on an original term of 10 years, will be 100.0% + the UUP of 0.850%, or 100.850%. The UUP on the successive Annual Optional Redemption Date (the Applicable UUP) will be 0.0944% lower than that in the previous year and will be reduced to 0.00% in the final year.

Uses and Applications

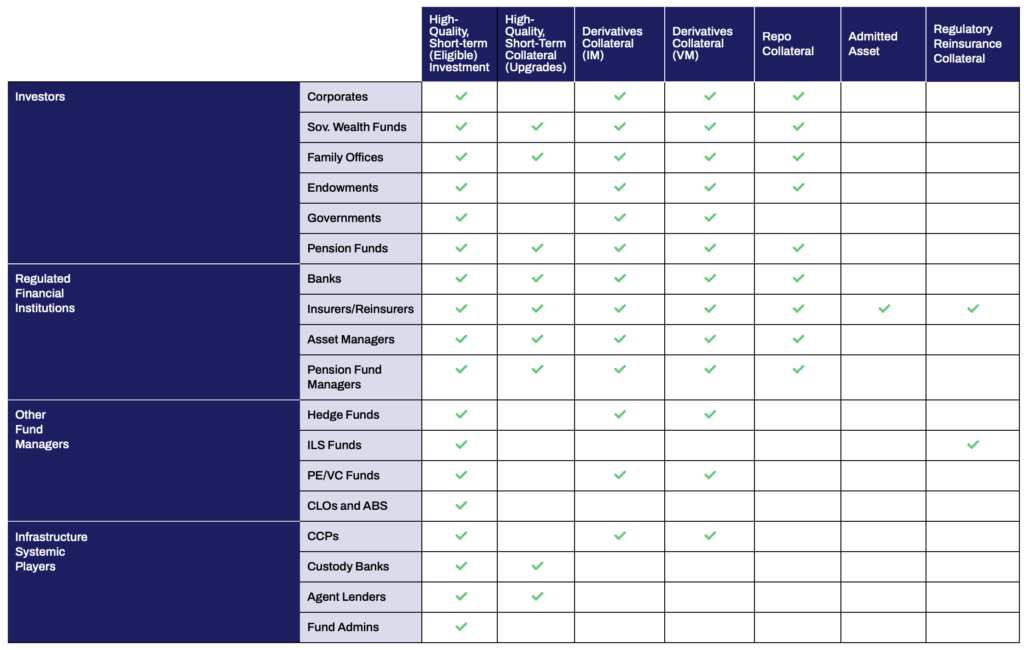

The table below summarizes the key RISCMTP-Note investor segments and applications.

Derivatives Collateral Applications

Eligibility under CFTC regulations

Cleared Derivatives: The U.S. Commodities Futures Trading Commission (CFTC) regulations establish a series of Core Principles that a clearing house, called a Derivatives Collateral Organization (or DCO) in the regulations, must comply with. While there are no specific criteria for Initial Margin, the Core Principles require the DCO to limit “the assets it accepts as initial margin to those that have minimal credit, market and liquidity risks.” (See 17 CFR Section 39.13(g)(10).)

There is no analogous provision for variation margin but in the case of both Initial and Variation Margin, “RFPS'” outside counsel has advised that a DCO has the flexibility to accept RISCMTP-Notes at the request of one of its members since they satisfy the “minimal credit, market and liquidity risks” guidance. On this basis, RISCMTP-Notes should be acceptable for Initial Margin and Variation Margin related to cleared derivatives.

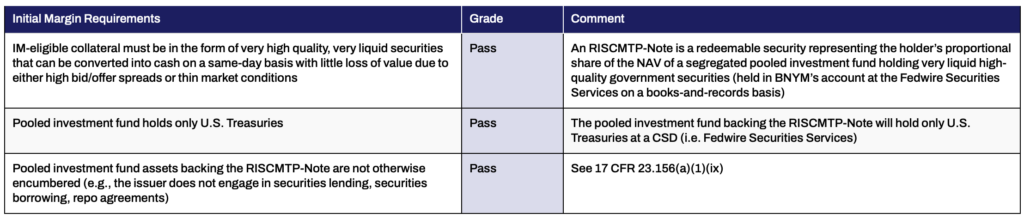

Bilateral Derivatives: According to 17 CFR Section 23.156, a covered swap entity shall collect and post as initial margin for trades with a covered counterparty collateral meeting the criteria in (a)(1)(i) though (x). According to 17 CFR Section 23. 156 (a)(1)(ix), Eligible Collateral may consist of:

(ix) Securities in the form of redeemable securities in a pooled investment fund representing the security-holder’s proportional interest in the fund’s net assets and that are issued and redeemed only on the basis of the market value of the fund’s net assets prepared each business day after the security-holder makes its investment commitment or redemption request to the fund, if the fund’s investments are limited to the following:

(A) Securities that are issued by, or unconditionally guaranteed as to the timely payment of principal and interest by, the U.S. Department of the Treasury, and immediately-available cash funds denominated in U.S. dollars; or

(B) Securities denominated in a common currency and issued by, or fully guaranteed as to the payment of principal and interest by, the European Central Bank or a sovereign entity that is assigned no higher than a 20 percent risk weight under the capital rules applicable to swap dealers subject to regulation by a prudential regulator, and immediately-available cash funds denominated in the same currency; and

(C) Assets of the fund may not be transferred through securities lending, securities borrowing, repurchase agreements, reverse repurchase agreements, or other means that involve the fund having rights to acquire the same or similar assets from the transferee.

Based on advice from counsel, RISCMTP-Notes qualify as Eligible Collateral as per 17 CFR 23.156 (a)(1)(ix).

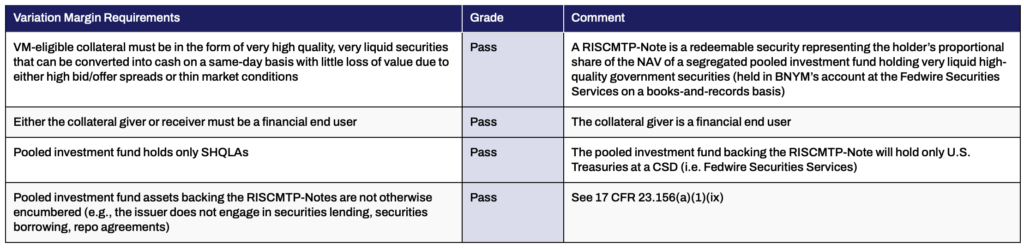

RISCMTP-Notes should also qualify as variation margin under 17 CFR 23.156 (b)(1)(ii) for financial end users, as follows:

(ii) Swap with a financial end user. A covered swap entity may post and collect as variation margin to or from a counterparty that is a financial end user any asset that is eligible to be posted or collected as initial margin under paragraphs (a)(1) of this section.

Initial and Variation Margin Compliance Test under CFTC Regulations

Eligibility under EMIR Regulations

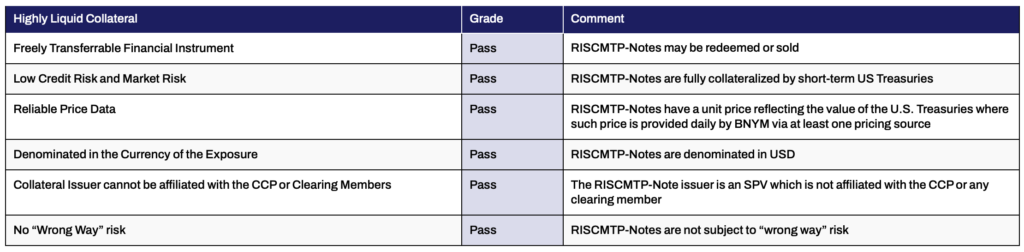

For the purposes of Article 46(1) of Regulation (EU) No 648/2012, highly liquid collateral in the form of financial instruments shall be transferable securities and money-market instruments which meet each of the following conditions as outlined in the table below:

Repo market Applications

As HQLAs and Risk-based Capital Charges

By definition under 12 CFR Part 329 Liquidity Coverage Ratio: Liquidity Risk Measurement Standards, Subpart C, 329.20, a Level 1 HQLA is a security that is issued by, or unconditionally guaranteed as to the timely payment of principal and interest by 1) the U.S. Department of the Treasury, 2) a U.S. government agency whose obligations are fully and explicitly guaranteed by the full faith and credit of the U.S. government, 3) a sovereign entity, 4) the Bank for International Settlements, 5) the International Monetary Fund, 6) the European Central Bank, 7) European Community, or 8) a multilateral development bank and that is also assigned a zero percent risk weight, liquid and readily marketable, issued or guaranteed by an entity whose obligations have a proven record as a reliable source of liquidity in repo or other sales markets during stressed market conditions, and not an obligation of a financial sector entity or consolidated subsidiary of a financial sector entity. While RISCMTP-Notes are backed by securities that meet the definition of Level 1 HQLA (i.e., securities issued by the U.S. Department of the Treasury), in the strict interpretation of the definition they are not issued by any of the issuers listed in 1) through 8) above. As a result, RISCMTP-Notes do not currently qualify as Level 1 HQLA; however, they can be redeemed for delivery in kind of U.S. Treasury securities for normal settlement. Based on our interpretation of the definition, RISCMTP-Notes would be Level 2B HQLA – an investment grade corporate obligation.

RISCMTP-Notes represent a proportionate interest in a pooled investment fund predominantly consisting of U.S. government securities backed by the full faith and credit of the United States. According to the “look-through approach” or LTA under BIS CRE60, banks holding investments in RISCMTP-Notes in the banking book should “risk weight the underlying exposures of a fund as if the exposures were held directly by the bank.” As the U.S. government securities carry a zero-risk weight, so should investments in RISCMTP-Notes.

RISCMTP-Notes meet the operational preconditions that the look-through approach requires. The assets in the fund are marked to market daily and the custodian of the fund (BNY Mellon) verifies that the fund’s assets consist solely of U.S. government securities. As the pooled investment fund does not employ leverage, banks holding RISCMTP-Notes need not make a leverage adjustment with respect to their investment in RISCMTP-Notes. Similarly, banks holding RISCMTP-Notes in the trading book may employ the look-through approach to calculate capital requirements. There will be no capital charge for specific issuer risk, as the underlying U.S. government securities have no such charge. The charge for general interest rate risk shall be the same as the bank would incur, if it were to hold the underlying securities directly. For further information see:

https://www.bis.org/basel_framework/chapter/CRE/60.htm

For U.S. insurance companies, we expect RISCMTP-Notes to be assigned the same NAIC rating designation as U.S. government bonds under the NAIC Investment RBC Charges table, which is NAIC 01.

In the U.S. and Canadian insurance / reinsurance markets, RISCMTP-Notes have been designed to satisfy the requirements of:

- the National Association of Insurance Commissioners (NAIC) Model Laws 785 and 786, as clarified in the Reinsurance Investment Security Subgroup memorandum issued on July 31, 2017, for reinsurance collateral and admitted assets for U.S. insurers, and

- OSFI in Canada for Reinsurance Security Arrangements

Under the NAIC guidance, RISCMTP-Notes may be delivered to beneficiaries as:

- Reserve-Credit-for-Reinsurance trust assets for property/casualty insurance transactions

- Reserve-Credit-for-Reinsurance trust assets for life/annuity insurance transactions not covered by Model Law AG48/#787

- Primary Security in an AG48/#787 life transaction as long as it is not part of a “regulatory transaction”

- Other Security in an AG48/#787 life transaction

- Collateral or admitted assets in relation to AG48-grandfathered life reserve financings, structured in such a manner as to not jeopardize the continued grandfathered status

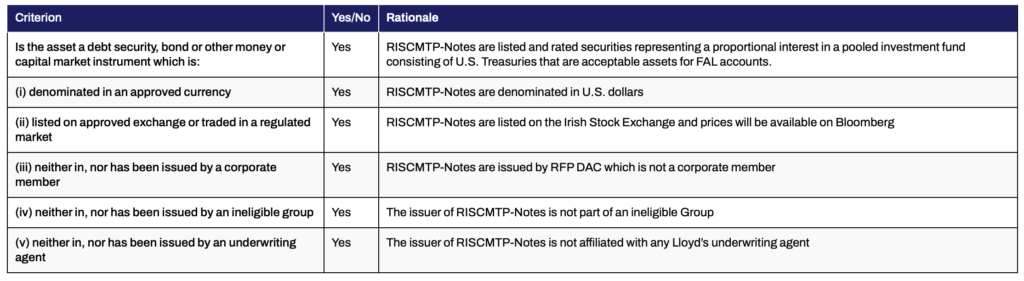

Funds at Lloyd’s

Based on an assessment of the Lloyd’s of London “Member and Underwriting Conditions and Requirements (Funds at Lloyd’s) Part C, paragraph 7 and Appendix 3″, RISCMTP-Notes have been designed to qualify as Tier 1 “Own Funds” for Lloyd’s (i.e., Funds at Lloyd’s) subject to Lloyd’s approval.

Rationale for Eligibility:

- RISCMTP-Notes are an investment similar to other debt securities, bonds and money and capital market instruments in Members’ FAL accounts that Lloyd’s identifies as acceptable assets in item 1(a) of Appendix 3 to the Membership and Underwriting Conditions and Requirements (Funds at Lloyd’s), thus forming part of its Tier 1 capital as noted above.

- A RISCMTP-Note is a security representing a proportional interest in a pooled investment fund predominantly consisting of short duration U.S. Treasuries.

- A RISCMTP-Note in a FAL account is immediately available to absorb loss and is not a contingent obligation of any party. Accordingly, RISCMTP-Notes in FAL accounts as an investment should qualify as part of Tier 1 capital.

Issuance and Use of Proceeds

RFP DAC (L.E.I. 5493000WIF6XDGUD2E77) is an orphan, insolvency-remote, single-purpose company with an independent board of directors that is administered under a trust agreement by a professional trustee (Wilmington Trust). The RISCMTP-Note is administered by The Bank of New York Mellon (BNY Mellon) in its capacity as custodian and Trustee for the benefit of Noteholders, and all RISCMTP-Note obligations are administered by BNY Mellon as issuing and paying agent, all as prescribed by legally binding agreements. Investors therefore are only exposed to the risks set out in the various legal agreements. The legal agreements also enumerate certain potential delays in payments and performance by BNY Mellon in the conduct of its duties. The investments making up the RISCMTP-Note Portfolio will be held in a CSD (i.e., U.S. Treasuries in the National Book-Entry System at the Federal Reserve and Servicing Assets in DTC). So, while the RISCMTP-Note Portfolio is recorded and administered on the books and records of BNY Mellon as belonging to the RISCMTP-Notes, the investors will not be exposed to BNY Mellon counterparty risk. Deposits with BNY Mellon will be recorded as cash on the books and records of BNY Mellon. This effectively segregates RFP DAC’s securities from those of the investment manager (the Investment Manager) and BNY Mellon.

Access to funds is provided via a detailed redemption process that is executed by BNY Mellon and the Investment Manager (See question 16 below).

Yes, RISCMTP-Notes will be listed on the Global Exchange Market in Dublin and admitted to the Official List of the Irish Stock Exchange, Dublin, and settled into and cleared by the DTC. Each Issue of RISCMTP-Notes shall have a unique market identification number (i.e., a CUSIP and an ISIN).

An amount equal to 1.0% of the principal amount of the Notes will be contributed to the Note Portfolio as a Utility Premium (the UP) to pay Annual Sponsor Fees. The Sponsor will use the UP to compensate itself and to pay the initial and ongoing fees of the Agents (other than the Investment Manager) and other expenses in connection with the ongoing maintenance of the Issuer and the Notes (in each case on behalf of the Issuer). The Sponsor will receive [0.15]% as the first year’s Annual Sponsor Fee of and the remaining balance of the UP (the Unamortized Utility Premium (UUP)) will be amortized and paid to the Sponsor annually on a straight-line basis in the amount of [0.094]% (the Annual Utility Premium or AUP) on the respective Annual Optional Redemption Date. The unamortized UUP from time to time will remain part of the Note Portfolio, will be invested in Permitted Investments and will be returned to Noteholders upon redemptions of Notes in accordance with Condition 6(D) (Issuer Call Option Redemption), Condition 6(E) (Redemption at the Option of Noteholders) and Condition 6(F) (Issuer Annual Optional Redemption). See “Fees, Costs and Expenses”.

Portfolio and Investment Management

All RISCMTP-Notes will have their issuance proceeds invested in a portfolio that is managed in a segregated account (the RISCMTP-Note Portfolio) by a professional investment manager (the Investment Manager) according to a specified set of investment criteria set out in the Investment Management Agreement (the IMA) for each RISCMTP-Note (the IMA Criteria).

The RISCMTP-Note Portfolio will be managed without leverage to provide:

- capital preservation

- liquidity

- low market volatility

- attractive performance characteristics (e.g., relative to Performance Benchmarks)

This is achieved by maintaining a weighted average maturity on the RISCMTP-Note Portfolio of 9 months or less and a maximum maturity for any single security in the RISCMTP-Note Portfolio not to exceed the next RISCMTP-Note Annual Optional Redemption Date.

The initial RISCMTP-Note Portfolio will be managed by DWS Investment Management Americas, Inc.

The RISCMTP-Note Portfolio will predominantly consist of short-duration U.S. Treasuries and credit securities that are managed by a professional manager of short-term investments. All Treasuries must mature and settle on or before the later of the RISCMTP-Note Annual Optional Redemption Date and the maturity date. Servicing Assets all have a maximum maturity of 60 days when acquired, provided that those with maturities exceeding 30 days may not exceed 10% of the RISCMTP-Note Portfolio. In any case, all Portfolio Assets must mature no later than the next Annual Optional Redemption.

Ratings

RISCMTP-Notes are expected to be rated [Aaa by Moody’s], which will rate the RISCMTP-Notes based on a look-through to the underlying securities (i.e., U.S. Treasury obligations).

Redemptions

Interim Redemptions

RISCMTP-Notes are redeemable at the investor’s option at any time for same-day settlement, either in the investor’s proportional share of RISCMTP-Note Portfolio assets, or in the cash received from the sale or liquidation of such assets (i.e., the liquidated asset value, or LAV) (in either case an In-Kind/LAV Redemption). Upon an In-Kind/LAV Redemption, the principal component may be more or less than the par value of the RISCMTP-Notes being redeemed and may also be more or less than the estimated RISCMTP-Note Portfolio NAV at the time of the redemption notice. Redemption settlement will be same-day, subject to the redemption notice being received no later than 8 a.m. New York time on any business day.

Annual Optional Redemption Date and Maturity Redemptions

RISCMTP-Notes can be redeemed by a noteholder or the Issuer for Book Value on the Annual Optional Redemption Date. Book Value shall consist of the par value of the Note plus the Unamortized Utility Premium.

RMTP–Note Redemption by the Issuer

The RISCMTP-Note issuer will have the right to execute one or more early redemption options at par (in whole or in part, the Issuer Call Option Redemptions) if:

- the Investment Manager is unable to reinvest sufficiently in U.S. Treasuries to maintain IMA concentration limits, or

- the Issuer has been unable to replace the Investment Manager or the Calculation Agent after its bankruptcy or termination, or

- the Investment Manager is unable to invest in Permitted Investments with a positive yield.

All Issuer Call Option Redemptions will be subject to Notice being given by the Manager on behalf of the Issuer and will be settled in cash on the date that payments are received on maturing RISCMTP-Note Portfolio securities as they mature. Settlement amounts received from the maturing RISCMTP-Note Portfolio securities will be paid to all RISCMTP-Note holders on a proportional basis.

BNY Mellon calculates the NAV as Calculation Agent. The In-Kind/LAV Redemption is based on actual prices of the underlying securities at time of redemption settlement.

The Investment Manager has a fiduciary responsibility to execute on the best possible price terms. Given that the underlying securities are predominantly short-duration U.S. Treasuries, the bid/offer spread is generally very tight, even in periods of overall market turbulence.

RFP DAC, BNY Mellon and the Investment Manager have agreed the process steps and mechanics required for RISCMTP-Note redemptions. BNY Mellon and the Investment Manager will each follow these agreed steps to process all redemptions.

Market Liquidity

-

- they can be sold in the Reg. S bond markets for cash. [RISCMTP-Notes are anticipated to be supported by market maker(s)]

- they can be redeemed at any time prior to their maturity date for the holder’s proportional share of the RISCMTP-Note Portfolio NAV in kind or the Liquidated Asset Value

- they can be used as collateral to borrow cash (subject to acceptability by a counterparty)

-

- hold the RISCMTP-Notes on a hedged or unhedged basis,

- redeem the RISCMTP-Notes at the actual liquidation value of the underlying securities (for same-day settlement, subject to cut-off times), or

- remarket the RISCMTP-Notes to other investors.

The bid/offer is expected to be very tight given that the underlying securities are short-duration U.S. Treasuries and credit securities.

Valuation

Each RISCMTP-Note will be valued daily by 11 a.m. UK time by the Calculation Agent (BNY Mellon). The daily value will be based on “end of day” values from the prior business day for each individual security within the RISCMTP-Note Portfolio with such values being sourced from prices provided by established vendors (e.g., Bloomberg and ICE) by the Calculation Agent using an automated process. The Calculation Agent then aggregates such prices (plus accrued interest) based on each security’s proportionate share of the RISCMTP-Note Portfolio to establish the RISCMTP-Note value.

The RISCMTP-Note value will be reported to Bloomberg daily by the Calculation Agent. The RISCMTP-Note value will appear on the Bloomberg screen by 11 a.m. UK time.

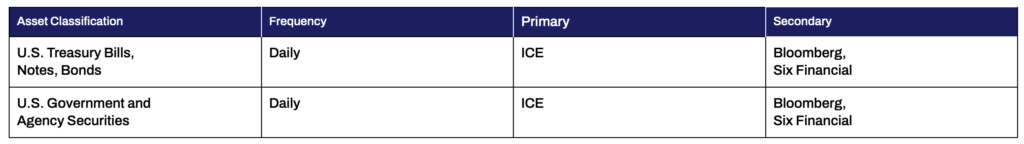

The Calculation Agent pulls prices for each security based on a price source waterfall that specifies the first priority price source, second priority price and so on. The prioritization is established based on the make-up of securities in the RISCMTP-Note Portfolio (See below for further details from BNY Mellon pricing guidelines). Given that all the underlying securities are listed and traded securities (i.e., U.S. Treasuries) with readily available prices from multiple sources, we expect that BNY Mellon will always have sufficient price data for the RISCMTP-Note valuation process.

From BNY Mellon Pricing Guidelines:

All pricing vendors are external. Primary and secondary price vendors for each asset type are listed in the Pricing Vendor Chart found at the end of the Guidelines. If a validated price is not available from the primary vendor source, a validated price from a secondary vendor is used. When a validated vendor price is not available, the last current price reported in the Securities Master Database (SMDB) system is used.

BNY Mellon validates prices supplied by pricing vendors as described below and may use a secondary vendor or change a primary vendor designation if a price for a particular security is not received from the primary vendor or the vendor no longer prices a particular asset type, class or issue.

When a pricing vendor does not send a price for a particular asset, it may indicate an inactive, delisted, bankrupt or suspended equity or bond for which our pricing vendors no longer have enough data to provide a price. In such cases, BNY Mellon systems would use a secondary vendor, if available. If a secondary vendor source is not available, BNY Mellon will reflect the last available price, or a transaction price.

Pricing Vendor Hierarchy

Yes, the value or NAV will vary daily based on the prices of the underlying securities. The RISCMTP-Note value/NAV will be available via Bloomberg (Ticker RFPSGP). BNY Mellon will report the RISCMTP-Note value to Bloomberg [once] daily and it will appear on the screen by 11 a.m. UK time.

As Investment Securities

The IMA provides for the RISCMTP-Notes to be predominantly backed by a portfolio of short-duration U.S. Treasuries and credit securities, as set out above, that must all mature and settle on or before the maturity date, but whose value is likely to fluctuate. The RISCMTP-Note Portfolio will be valued daily, and a value for the RISCMTP-Notes will be derived by BNY Mellon as described above. Actual market trading prices will only be known once the security begins trading, but are not expected to deviate dramatically from the valuations provided to Bloomberg.

To manage through this environment, the Investment Manager has indicated that the investment strategy would be to extend the weighted average maturity of the RISCMTP-Note Portfolio investments. A longer/extended duration allows the RISCMTP-Note Portfolio to benefit from the prevailing level of interest rates prior to a Fed Funds rate cut during the investment horizon. By adjusting purchases to a larger allocation of fixed rate investments (vs. floating “short-reset” investments) and taking advantage of the longer part of the yield curve, the RISCMTP-Note Portfolio yield is expected to lag the drop in the Fed Funds rate, thereby outperforming over time.

To ensure that it may sell securities in the Note Portfolio at any time, the Investment Manager maintains trading relationships with a large, diverse and active list of potential market-makers willing to provide bid/offer pricing. In a stressed market, there is typically a flight to quality and demand for U.S. Treasury securities increases significantly. In this scenario, Treasury prices increase, and yields fall, usually resulting in significant realized gains upon the sale of securities in a treasury portfolio.

The RISCMTP-Note Portfolio will be actively managed by a leading Investment Manager to optimize returns. However, it should also be noted that RISCMTP-Notes have been designed to support a range of market applications and their utility options should be considered in concert with their investment attributes. As exchange-listed, rated and transferable securities with market I.D. numbers and prices, they should be able to be used as collateral with central banks (because they are backed by very high quality liquid assets) and can be used for derivatives collateral (initial and variation margin under Dodd-Frank and EMIR rules) and as admitted assets or reinsurance collateral for insurance companies (See Question 4 for a complete list of applications). RISCMTP-Notes provide for the underlying collateral to be managed in a single account while RISCMTP-Notes can be delivered to specified counterparties, counterparty accounts and beneficiaries without having to move individual securities. RISCMTP-Notes should therefore be considered not only for their investment characteristics but also for their various market applications. If they are considered purely for investment purposes, then a sophisticated investor would have to evaluate its own investment expertise relative to that of the Investment Manager.

Other

Yes, RISCMTP-Note holders with a registered account at BNY Mellon can log in to see the portfolio holdings via the BNY Mellon NEXEN technology platform.

No rehypothecation or re-use (e.g., via repurchase agreements or securities lending) is permitted. The RISCMTP-Notes themselves can be repo’d or used in securities lending arrangements by the noteholder.